here was a time when a steady job at a reputable company provided health insurance, vacation, sick days, a retirement plan, and maybe even life insurance. Some companies offered these benefits as part of the employment package, others as a co-pay option far below the cost of individual insurance. These days, however, having a job doesn’t guarantee insurance. While many freelancers choose self-employment with its inherent risks, many have only recently been pushed into it.

ARE YOU A STATISTIC?

If you don’t have health insurance because your “day job” company has made cutbacks, or you’ve been without healthcare throughout unemployment, freelancing, or part-time employment, you’re not alone. Even before this most recent economic downturn, there was a health crisis in America. Freelancers and those who are self-employed, such as writers, photographers, and graphic designers are at an even greater risk for being uninsured than those in other professions.

According to the Bureau of Labor Statistics, the percentage of self-employed workers nationwide has increased since 1996. Most self-employment statistics, however, are centered in the New York metropolitan area, which is one of the few cities that keep accurate self-employment statistics. The 2005 report put out by Freelancers Union, which uses those statistics, cited an increasing freelance class as well. They also pointed out that unstable income and lack of health insurance were the two basic issues freelancers face that other regularly employed Americans do not. This is no great news. However, counter to what has been true in the past, freelancing does not necessarily translate into greater income.

Especially in this economy where greater unemployment means more potential competition in the freelance pool, and therefore lower prices, freelancers who may have more experience than those just entering the market are making less money. Yet the cost of health care has increased beyond what is affordable. Factor in self-employment and social security taxes and the freelancer ends up struggling to pay for her own healthcare. According to that 2005 report by Freelancers Union, 28% of freelancers simply lived without any healthcare insurance at all.

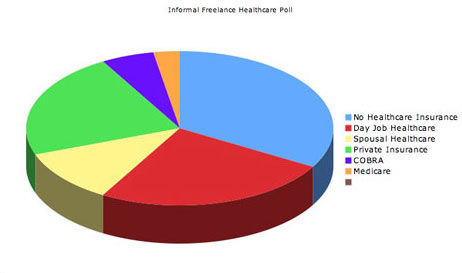

In researching this article, I decided to do a casual poll of my own to ask freelancers I know how they attend to their own health care. Do they have insurance? If so, how did they get it and what was the cost? Or did they just cross their fingers and hope they didn’t get too sick? Here are the numbers (you will note an obvious skew towards the West Coast because that is where many of the freelancers I know live):

Out of 48 total freelancers polled, there were 37 responses. Three of them were from out of the country. Of those living in the United States, two were from the East Coast, 22 from the West Coast, and 11 from the Southern/Midwestern states. There was an almost even mix of men and women with ages ranging from mid-twenties to mid-seventies.

Twelve freelancers polled, or about 31.5% (greater than the percentage quoted in the Freelancers Union report), have no insurance at all and either pay out of pocket, hope they never get sick, or try to take advantage of any public health facilities available to them. Nine of those self-employed, or about 24%, are also working “day jobs” or some other type of work through which they obtain health insurance, while eight, or about 21%, of those who work from home have purchased private health insurance. Four freelancers (10.5%) have health insurance through their spouses. Two freelancers were on COBRA at the time of the original polling, but have since moved on. One now has no insurance at all, and the other has found a job where the employer provides health insurance. (He pursues his freelance work on the side.) Two freelancers have access to socialized medicine. And one writer is on Medicare. See pie chart below.

These are pretty grim statistics, whether from Freelancers Union, or my own poll. A full third are without healthcare. Period. That number can easily go up as insurance companies increase rates, which can lead to people who can no longer afford to cover spouses on their insurance, or can no longer afford to pay for their own insurance or who lose that (probably part-time) day job that gives them just the slightest amount of stability.

“The primary concern is determining specifically what is needed and how much you can afford to pay.”

NEVER SAY DIE

One of the traits of a freelancer or self-employed person is they tend to be tenacious and creative. You have to be to survive. There are ways to find some of the health necessities you need, or to even become insured without going broke. And if you live on the East Coast, you are at a greater advantage, since there are more programs than in other parts of the United States.

For example, aside from the Freelancers Union (freelancersunion.org), which works for freelancer equity across the U.S., but is mostly centered in New York, there is also Media Bistro (mediabistro.com). Both of these organizations have been able to sell the idea of freelancers as a collective guild to insurance companies. Insurance companies give a lower group rate to anyone who signs up for health insurance through these two organizations. Applicants may need to be paying members of these organizations and meet certain eligibility requirements to be eligible for this insurance.

Another online source, the All Freelance Directory has links to different online sources, such as eHealthInsurance.com and InsureMe.com, which are supposed to be more affordable for the freelancer. While this may or may not be true, online directories such as All Freelance, can also point researchers in the direction of special self-employment insurance plans such as Blue Cross’s Anthem and Kaiser Permanente that may have more affordable options. In any of the above cases, for me—a single, middle-aged woman, the average insurance quote for adequate health insurance, not including dental or vision, was at least $300/month, usually closer to $400.

The primary concern is determining specifically what is needed and how much you can afford to pay. I’m pretty sure I can afford to pay about $50/month. So, I need to look at other options.

If you have just recently lost employment where you had healthcare insurance, you can sign on with COBRA, of course, which usually comes with a certain amount of sticker shock. Comparatively speaking COBRA isn’t that much less expensive than paying for private insurance; however, you cannot be denied insurance, as you could be with private insurance. Recently, a fund was created so those unemployed between September 1, 2008 and December 31, 2009 can be eligible for a 65% reduction in their COBRA rates, providing they meet certain requirements. While this may not take care of freelancers’ health insurance hell forever, it does make purgatory a little more bearable.

LOOK FOR THE FREEBIES

Yes, there are freebies out there. But, like looking for more freelance gigs, you always have to keep your ear to the ground.

- Drugstores and pharmacies frequently have blood pressure machines available for anyone to use for free. If you know that’s a trouble area, take advantage and make that free machine one of your stops.

- Look for programs like RxAssist, an online patient-assistance program that helps you find some of the medications you may need but can’t afford.

- If you are paying a lot for medication, ask your pharmacist about generic replacements that may be available.

- Every winter there are public service announcements about locations where people can receive free flu shots. Sometimes, there are even medical personnel available to give you a mini-check up while you’re at it.

- If you are on the brink of losing your healthcare insurance, but need to continue care somehow, talk to your doctor. There are doctors out there who, once they know your circumstances, can direct you to programs that can help. If you need medication, they can offer free samples. Don’t be afraid to ask.

- If you’re in good health, consider getting insurance that only covers emergency medical care or catastrophes. While these policies won’t cover doctor visits or medication, they will tide you over should you have a major medical problem, and their monthly premiums are typically less expensive.

- If you’re income has fallen below a certain amount (and many freelancing incomes have), you may be eligible to receive healthcare through free clinics or public health programs. While it may take you a few months and several eligibility forms to get an appointment, once in, you will receive medical attention.

“Be your own advocate, learn the language, and fight for people to listen to you because no one else is going to do it for you.

IN THE END, IF IT SOUNDS TOO GOOD TO BE TRUE…

It probably is. Do your due diligence when researching what appear to be cut-rate physicians, medical offices, or insurance companies. In addition, when paying medical bills, pay close attention to what is listed on those bills. If you have a question about a charge, call and ask. Be your own advocate, learn the language, and fight for people to listen to you because no one else is going to do it for you.

Many of the freelancers I spoke with who live without medical insurance do their best to exercise, eat healthy, take vitamins and supplements, and generally do what they can naturally to fill in that gap. In essence, they’ve had to apply the same ingenuity they use to land and fulfill contracts and gigs, and make a living to take care of their health. It is not an impossible task, but it is daunting. Just approach it like you do any assignment, one bit at a time, and you’ll be fine.

Sources:

COBRA Continuation Coverage Assistance under the American Recovery and Reinvestment Act of 2009. United States Department of Labor. Accessed online at: https://www.dol.gov/ebsa/cobra.html

Horowitz, Sara; Buchanan, Stephanie; Alexandris, Monica; Anteby, Michel; Rothman, Naomi; Syman, Stefanie; and Vural, Leyla. 2005 Report: The Rise of the Freelance Class – A New Constituency of Workers Building a Social Safety Net. Freelancers Union. Access at www.freelancersunion.org.

Vanderkam, Laura. The Promise and Peril of the Freelance Economy. City Journal. Winter 2009. Vol. 19, no. 1. Accessed online at: https://www.city-journal.org/2009/19_1_self-employment.html

Rachel V. Olivier is a freelance proofreader, copy editor, and writer. In addition, she works part-time as a Girl Friday at the Larchmont Chronicle in Los Angeles, California and is a regular contributor to Chocolate Zoom and Tyrannosaurus Press' The Illuminata. For more information, check out her website at www.puttputtproductions.com.